Why is a Retirement Plan Important?

As retirement specialists, we dedicate our professional lives to helping retirees and pre-retirees navigate the rough waters of transitioning their investment dollars from a “growth-at-all costs” mode to the preservation, income protection and distribution mode.

What many financial professionals and retirees alike fail to recognize is that when it comes to investing hard-earned dollars for retirement purposes, success is less about investing and more about the protection and growth of one’s assets. It’s essential to create a retirement plan with contractually guaranteed lifetime income* and a legacy that leverages what is left to your beneficiaries in the most tax-effective strategies.

Today’s retirement landscape is vastly different than the decades that preceded us. Retirement is ALL ABOUT A PLAN. As T. Boone Pickens once said, “An idiot with a plan will outsmart a genius with no plan.” Remember, there are “no do-overs” in retirement. There is no room for mistakes.

While you can afford to “miss the mark” when accumulating wealth in your working years, in retirement, you don’t have the luxury of waiting for a market correction. This is especially true if your “retirement plan” is to simply take out 4% of your total investable assets, a plan that studies have shown to be flawed and risky. If not preserved and distributed properly, the risk of running out of money during retirement can be greater than once thought. After all, you’ve spent a lifetime working hard and saving to get where you are now. Today’s risks are abundant: longevity risk, health care risk, inflation risk and market risk. The investment plans of yesterday are all but extinct. What worked in the past may not work today. Add to those risks that we live in a virtually pension-less society, one where our Social Security system is under duress, and the focus for today’s retirement plans must be on providing reliable income sources.

Retirement is all about a Plan

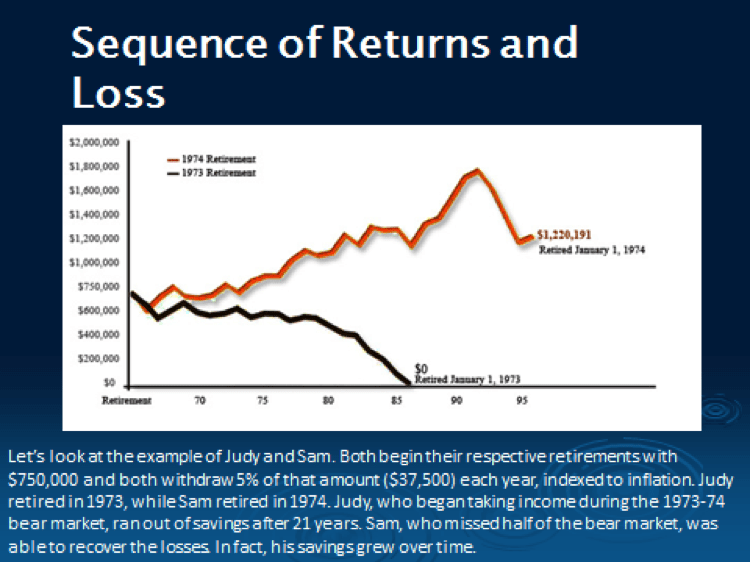

According to a 2013 study by The National Institute on Retirement Security, poverty rates for older Americans who lack pensions are nine times greater than those who left the workforce with a defined benefit! There are many reasons for this, one of which has to do with sequencing risk. Traditionally, most retirees have relied on withdrawing a fixed percentage from their equity portfolio to provide them income during retirement. The problem is the risk of outliving your money can be significant if, during the five years prior to retirement and/or the first five years after retirement, we see a market correction. Unless you can predict when we will have the next bear market and how long it will last, the risk of outliving your money can never be greater. Let’s look at an example of this sequencing risk below. As you can see, both Judy and Sam started with the same amount in their retirement and both withdrew the same 5% out of their portfolio every year for income. Still, Judy ran out of her retirement money after 21 years, while Sam never outlived his retirement, and in fact, left $1.2 million to his heirs when he passed. The difference was Sam retired one year after Judy, and as a result, missed half of the bear market. One year difference can make or break your retirement and determine whether you will have lifetime income and security.

This is a risk you can’t afford to take.

What is a 5-Star Retirement Plan?

The key to having independence and financial security is having a well-disciplined plan that addresses four essential areas in retirement. In order to help our clients navigate retirement, we have developed a holistic approach using a four-bucket asset allocation strategy. Each bucket has a distinct purpose that contributes to long-lasting financial security.

If at some point you have an emergency and need money, and if that emergency happens during a bear market, as long as you have sufficient liquidity, you will not have to sell your investments to create the cash you need.

This is the most important bucket in our plan that provides contractually guaranteed lifetime income.*

Depending on the interest rate environment and market conditions, a conservative bond portfolio made up of investment-grade, shorter-duration bonds can be part of the plan. However, with the fluctuating interest rate environment and market conditions, we have found some annuities to be highly effective in creating guaranteed lifetime income.* In fact, the Wharton School of Business conducted a study** in which researchers determined that the best way to preserve your retirement income is through the appropriate use of income-generating annuities. One of the additional benefits of some types of annuities is that they also provide for long-term care without paying exorbitant premiums. If you are 65 and married, there is a 50% chance that one of you will need long-term care. Long-term care needs cannot be overlooked, and if you are looking for long-term care insurance, be prepared to pay very high premiums from which you may never actually reap the benefits. There are many different options available, so it is important to work with someone who has experience working with these extremely complex products (not just an insurance salesman). There are a number of different ways to structure this bucket by using different products at different stages of your retirement years. Remember that as we get older, the letters “ROI” have less to do with “return on investment” and more to do with “reliability of income.”

The purpose of this bucket is to help you grow your wealth without risking your quality of life. While this bucket carries some potential risk, as long as we have developed a sound plan that provides sufficient, lifetime income, our clients should not be forced by need or fear to sell market assets at the worst time and lock in losses. This approach removes the emotions that often occur with many investors when making market decisions, and it helps to avoid the subsequent mistakes.

It is important to understand that through Strategic Investment Advisors, an independent RIA, we have a fiduciary responsibility to our clients. In contrast to a broker, who first represents the firm’s needs, then the shareholder’s needs, and finally the client’s needs, as a fiduciary, we have to disclose all fees or any conflicts of interest and represent the client’s needs first. Another significant advantage to our firm is that our clients have access to an institutional approach, on an institutional platform, with institutional investment options, which is often not the case with a major brokerage firm.

Why do you care? While retail products such as mutual funds allow the public to access financial markets, there are significant costs that are often hidden to the client. For example, when purchasing a mutual fund, you often pay distribution and marketing costs, internal trading commissions and brokers’ commissions. All of these costs are built into these funds in order to make large brokerage firms more profitable. As an institutional advisor, we are often able to bypass these additional costs.

Many of us would like to leave a legacy to those we love, but we also want the freedom to thoroughly enjoy our retirement years. Creating a fixed financial legacy for your beneficiaries from life insurance can give you a “permission slip” to spend more of your own hard-earned money in retirement, knowing that you will still be leaving a financial blessing for your loved ones after you are gone. In addition, proper planning of IRA distributions (Stretch IRAs) is another way to provide a legacy for your beneficiaries.

Incorrect designation of beneficiaries is a mistake we often see, in which clients have accidentally and unknowingly disinherited their children. Making sure your legacy is correctly bequeathed is a critical part of our planning process. Some of our clients also hope to leave a legacy to charities, and we have a number of different methods to accomplish this goal. Some of these are through life insurance, endowments set aside in the will or a charitable annuity trust. A charitable annuity trust is a legacy that can be established while you are alive, and it allows you to receive income as well as tax advantages.

While this process may appear simple, our holistic approach requires discipline and strategy. It’s important to know how to allocate the right assets to each bucket at the most beneficial times, in order to create the most tax-efficient income in retirement and find the most tax-efficient way to pass your assets to your beneficiaries. For the best and most secure results, this process requires an advisor with specific knowledge, experience, and expertise in retirement planning.

Are you working with the right specialist?

Whether you realize it or not, the advisor or firm you choose to work with plays an integral part in determining whether or not you are on track for the retirement you desire. There are many different types of financial professionals in today’s marketplace. Does your advisor operate under the “suitability standard,” or is he/she a “fiduciary”? Are you working with an accumulation-and-growth-at-all-cost advisor, or someone who specializes in preservation and income distribution? Are you on a retail platform or on an institutional platform? Check out more in the Our Process tab to learn more about Finding and Hiring the RIGHT Advisor!

*Guarantees are backed by the financial strength and claims-paying ability of the issuing company, and may be subject to restrictions, limitations or early withdrawal fees. Annuities are not FDIC -nsured.

**Wharton Financial Institutions Center, Personal Finance, Real World Index Annuity Returns, Revised Version, March 4, 2010

Bucket #1: Liquidity

Bucket #1: Liquidity Bucket #2: Lifetime Income

Bucket #2: Lifetime Income Bucket #3: Long-Term Growth

Bucket #3: Long-Term Growth Bucket #4: Legacy

Bucket #4: Legacy